Funding Frustrations?

Discover what's blocking your access to capital

Profit Problems?

Fix Your Financial Blind Spots

See where you're actually making (or losing) money

Growth Stalled?

Break Through Your Ceiling

Scale from $3M-$50M without the chaos

Building to Sell?

Maximize Your Valuation

Increase what buyers will pay for your business

Not sure which problem to tackle first?

Free Assessments

BLAST™ Borrowing Power Assessment

Growth Ceiling Assessment

Free Guides

The Funding Readiness Checklist

Profit Leaks: Where Your Money Goes

The Growth Bottleneck Diagnostic

Valuation Multipliers Explained

Ongoing Learning

Blog: Strategic Growth Insights

Newsletter: The Grumpy CFO Weekly

Fractional CFO Guide

Book Phil

Hire Phil to Speak

Phil's Book: "The Business Wealth Builders"

Break Your B2B Growth Ceiling – Grow Profit & Valuation with Strategic CFO Expertise

You're successful, but stuck. We help B2B owners break through invisible growth barriers to build wealth and freedom.

Find Your Stage Based On What You Need

Stage 1:

Get Control

Stage 2:

Growth Accelerator

Stage 3:

Increase Valuation

Stage 4:

Raise Capital

FREEDOM

Challenge: Hit capacity ceiling, team burnout, bank hesitation

Outcome: Stable strategic growth with clear action plans & next steps

Challenge: Cash flow rollercoaster, reactive management

Outcome: Have an expert create financial clarity and operational control to increase profits

Challenge: Need growth capital, banks won't lend enough

Outcome: Proper reporting & capital structure for funding growth

Challenge: Unknown business value, owner dependency

Outcome: Maximized valuation and owner freedom

Total value $7,000. Your investment, only $1,500

Only 4 spots available each month.

Find Your Stage Based On What You Need

Stage 1:

Get Control

Challenge: Hit capacity ceiling, team burnout, bank hesitation

Outcome: Stable strategic growth with clear action plans & next steps

Stage 2:

Growth Accelerator

Challenge: Cash flow rollercoaster, reactive management

Outcome: Have an expert create financial clarity and operational control to increase profits

Stage 3:

Increase Valuation

Challenge: Need growth capital, banks won't lend enough

Outcome: Proper reporting & capital structure for funding growth

Stage 4:

Raise Capital

Challenge: Unknown business value, owner dependency

Outcome: Maximized valuation and owner freedom

FREEDOM

Total value $7,000. Your investment, only $1,500

Only 4 spots available each month.

You've Hit Your Growth Ceiling And You're Not Alone

Your business is profitable. Your customers are loyal. Your team delivers.

So Why Does The Next Level Feel Impossible?

Research shows 53% of U.S. businesses seeking growth capital face financing shortfalls. In Canada, high-growth companies often receive only 75% of requested funding.

You're not broken.

You've hit a predictable barrier that most successful companies face between $3-30M.

The symptoms:

Working harder but gaining less freedom

Bank says "no" despite strong performance

Profit growth lags behind revenue growth

Cash is getting tighter

Can't fund the growth your customers demand

The truth: What got you here won't get you there. Your existing systems worked to build a $5M company, but these same systems are now blocking your progress.

Free 5-minute quiz to discover your stage and unlock your next level.

What Owners Say

Client Results Speak Volumes

"Phil's advice helped us dramatically increase our business—and personal—wealth. Our financial worth has increased substantially."

"In the first year, we lost $60,000. The next year, we made $140,000 profit. Phil's fees returned many times over."

From $8 Million to $55 Million: How Jake Broke Through

Banker Doug called me about his client, Jake: "Good business, needs growth capital, but doesn't qualify." When I met Jake, he asked what every owner asks: "Why'd the bank turn me down?"

Banks have rules. If you don't meet them, they say no. But Doug believed in Jake's potential. That's why he introduced us.

Jake was productive, driven, turning down customer work because he couldn't scale. He had the capacity but not the capital strategy.

"Do you know which customers make you the most money?"

I asked. "Nope," Jake said. "We'll fix that."

The result? $8M to $55M revenue growth over several years. One year: $26M to $36M (40% growth) with 293% profit improvement. We increased Doug’s confidence. Funded with a $4.5 million line of credit and debt for CapEx.

This is how owners grow from the kitchen table to the boardroom, by getting the right strategic help.

to see if we're a good fit.

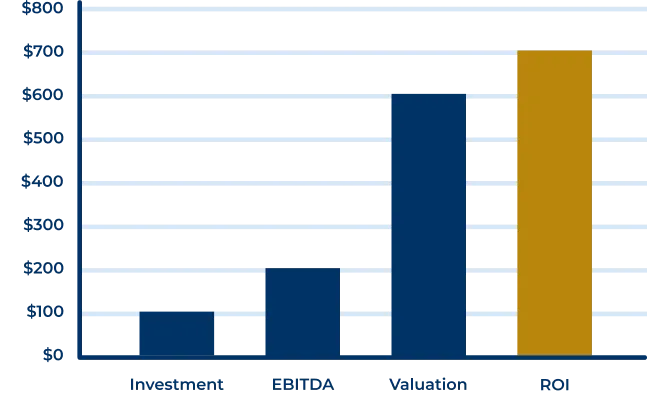

The ROI Reality

Typical Stage 2 client: $5M revenue improves bottom line by $200K annually (after our fees). That $200K EBITDA improvement can increase business value by $600K to $1M using standard multiples.

Your investment: ~$100K Year 1

Your return: $200K+ higher profit + $600K higher valuation = $800K = 800%+ ROI

The alternative: Stay plateaued while competitors break through their ceilings and chase your customers and employees.

Why Trust Phil?

Your numbers deserve more than guesswork. Here's why owners rely on me when the stakes are high:

30+ years providing CFO, Strategy, and Consulting advice to owners who demand clarity and results

CPA, MBA, Certified Management Consultant, and Certified Director. I don't just talk the talk, I've walked it in boardrooms and on the shop floor

Partnered with 150+ companies - from Main Street businesses ($1M-$30M) to big names like AFD Petroleum, PCL Construction, Prairie Clean Enterprises, and even a Tim Hortons franchisee with multiple locations.

Featured in Industry West, Manitoba Inc., and Costco magazine - recognized for helping owners get results

Author of "The Business Wealth Builders" - because building owner wealth isn't an accident, it's a system

Clients trust me for straight talk, steady coaching, and zero hype - just practical, actionable results

"You don't have time for philosophies and fluff. I analyze the data and we figure out what to do. Let's get to work."

— Phil Symchych

to see if we're a good fit.

The Four Stages of B2B Growth:

Where Are You? What do you need? What do you want?

Stage 1:

Improve Profit and Performance

Challenge: Cash flow rollercoaster, reactive management

Outcome: Have an expert create financial clarity and operational control to increase profits

Stage 2:

B2B Growth Accelerator

Challenge: Hit capacity ceiling, team burnout, bank hesitation

Outcome: Stable strategic growth with clear action plans & next steps

Stage 3:

Increase Valuation

Challenge: Unknown business value, owner dependency

Outcome: Maximized valuation and owner freedom

Stage 4:

Raise Capital –

our BLAST process

Challenge: Need growth capital,

banks won't lend enough

Outcome: Proper reporting & capital structure for funding growth

What You Get Across All Stages:

Financial clarity through proven systems and reporting so you can make better decisions, faster, without guessing

Growth strategy based on your actual numbers and capacity and built on your strengths

Banker relationships that unlock capital for expansion by building trust and strengthening understanding and relationships

Implementation support to ensure results, not just plans, so you can make positive progress on your goals, increase momentum, and sleep better at night

Discover Your Stage and Breakthrough Strategy

Take our Growth Ceiling Assessment. Get your custom roadmap in 5 minutes.

Many owners just like you feel isolated in their growth struggles. The truth: all successful entrepreneurs hit these ceilings. The difference is knowing which stage you're in and the specific strategy to break through.

What Experts Say

"We trust him. Phil helps us lend more money into lower risk situations."

"Phil creates growth in front of your eyes. Your valuation will dramatically improve."

How We Break Through Growth Ceilings

Need to fund growth? Your next step: The BLAST System

Business Loan Accelerator: Strategy & Trust – invest $1,500 and discover your borrowing potential and how to improve it. (total value $7,000)

Save $5,500 today. Limited BLAST slots each month.

“Phil helped us set our books up to do the right kind of reporting for bankers and to help me understand my costs so that I can negotiate with customers.”

— CEO/Founder, $8M revenue B2B service company that grew to $50 million

Uncover your true borrowing capacity and get a clear roadmap to unlock growth capital.

Estimate current and potential borrowing power ($3,000 value)

Identify specific financial gaps holding you back ($1,000 value)

Get 2-page BLAST Report & Action Plan ($2,000 value)

30-minute financial review with The Grumpy CFO® ($1,000 value)

Total value $7,000. Your investment, only $1,500 Only 4 spots available each month.

100% Money-Back Guarantee if we don’t’ find $100K+ borrowing potential

How BLAST™ Works:

STEP 1

Take Free BLAST Assessment

STEP 2

Book a

Discovery Call

STEP 3

Work with us &

Get Your BLAST Report

Or, if you want to know now, then Buy Now

Total value $7,000, invest $1,500

and let’s calculate your borrowing potential and how to get there.

FAQs: The 5 Questions

Every Owner Asks

What's the investment?

If we’re a fit, we expect to have a significant impact on your business, more than six figures, and likely seven figures, of improved earnings and valuation. Investments vary on the project scope and potential impact to you. My goal is to provide you with a high ROI, usually 300% to 400% or more, in the first year alone. Although, we can’t guarantee those results. So, let’s talk and see if we’re a good fit.

What could go wrong?

Success requires implementing recommendations. Some work better than others, so we learn together. If your bookkeeping isn't current, fix that first, so we have accurate data to analyze. And, we all have the normal business risks such as losing a client or customer or key employee.

How are you different?

I (yes, me, not a team of juniors you’re paying to learn) provide senior-level strategic and CFO expertise without big-firm costs to drive quick, measurable results. I’m accessible and responsive. You get my personal cell number. I don’t have hourly rates and don’t charge admin fees. Big firms have big overheads and junior staff. Basic accountants don't drive growth and they focus on the past, not the future. You get advice from me, like you I’m a business founder and owner, and not just an employee of a large company.

What do clients say?

See testimonials above and throughout the site. Research shows businesses with strategic financial guidance are 40% more likely to achieve growth goals. Many of my clients are long-term relationships, because we get results and they keep growing.

Why trust Phil?

I’ve been through some battles, 34 years’ experience, worked with 150+ companies, 65 industry segments (most innovation comes from outside any specific industry), clients in 7 countries. CPA, MBA, CMC, ICD.D. Author of "The Business Wealth Builders." I grew up in a family business when rates were 23%...I understand financial stress and the pressure of being an owner.

to see if we're a good fit.

You're Not Alone –

And You Don't Have to

Stay Stuck

The most successful business leaders—like elite athletes—surround themselves with experts and coaches. Asking for strategic help isn't weakness; it's what separates those who break through from those who stay stuck.

The next five years will pass whether we work together or not. The question is: will you break through your growth ceiling or remain trapped beneath it?

Step 1: Take the Growth Ceiling Assessment

Step 2: Book a strategy call to see if we're a good fit

Step 3: Get your custom Grumpy CFO® Profitable Growth plan

to see if we're a good fit.

The Grumpy CFO® specializes in strategic CFO services for B2B business owners earning $3-30+ million annually. We provide clear numbers, straight answers, and proven systems to break through growth ceilings and build the wealth and freedom you deserve.

Phil Symchych, CPA, MBA, CMC, ICD.D

The Business Wealth Builder®

The Grumpy CFO®

Originally Established 1994®

CONTACT

PHIL SYMCHYCH

(Toll-free North America)

Regina, Saskatchewan,

Canada

© 2026 Grumpy CFO. The Business Wealth Builder® and The Grumpy CFO® are registered trademarks. All Rights Reserved.