Funding Frustrations?

Discover what's blocking your access to capital

Profit Problems?

Fix Your Financial Blind Spots

See where you're actually making (or losing) money

Growth Stalled?

Break Through Your Ceiling

Scale from $3M-$50M without the chaos

Building to Sell?

Maximize Your Valuation

Increase what buyers will pay for your business

Not sure which problem to tackle first?

Free Assessments

BLAST™ Borrowing Power Assessment

Growth Ceiling Assessment

Free Guides

The Funding Readiness Checklist

Profit Leaks: Where Your Money Goes

The Growth Bottleneck Diagnostic

Valuation Multipliers Explained

Ongoing Learning

Blog: Strategic Growth Insights

Newsletter: The Grumpy CFO Weekly

Fractional CFO Guide

Book Phil

Hire Phil to Speak

Phil's Book: "The Business Wealth Builders"

How Much Could Your Business Borrow – Today and Tomorrow?

BLAST™: The smarter, low-fee way to know your true borrowing power… and exactly how to grow it.

Phil helped us set our books up to do the right kind of reporting for bankers and to help me understand my costs so that I can negotiate with customers.

Mini Case study: For the above client, I obtained a $4.5 million margined line of credit that helped them to accelerate profitable growth and scale significantly.

What is BLAST™?

Business Loan Accelerator: Strategy and Trust (BLAST™) is Grumpy CFO®’s signature, strategy-first financing analysis that answers the question every owner eventually faces: How much could my business actually borrow today, and if I improve?

Most business across all industries could grow more efficiently if they had more financing to support growth.

Is your lack of funding holding your back?

Are you growing and profitable yet cash flow is tight?

These are very common signs that your business is a good candidate for more funding.

You’re busy running a growing business, helping customers, and supporting your team. Yet as you grow, more cash goes out than comes in.

That’s just part of growth.

But it doesn’t have to be that way.

Stop stressing about cash flow and payroll.

In just days, you’ll get clear answers, practical next steps, and a plan to boost your financing options. All without jargon, hassle, or surprise fees.

Stats – Is this you?

20%

Of companies that are high growth, faster than 10% per year, are severely underfunded

53%

Of US SMEs experienced a funding shortfall

75%

Of growing companies are under-funded because they don’t know their true future needs, so…they just didn’t ask for enough financing. Don’t make that mistake.

(from Phil’s three plus decades of experience and hundreds of discussions with bankers)

Take the Free BLAST™ Assessment. Identify what’s working and what isn’t in your financial reporting system.

No obligation, just clarity.

First, a quick, true story.

One of my clients was a contractor who was growing from $3 million to $4 million in revenue in about a year. That’s healthy growth. Profit was good.

Problem was that cash was tight. They were scrambling to meet payroll and pay suppliers, even though profit was strong.

Why, you ask?

They only had a $100,000 line of credit. They needed a $400,000 line. Since everyone gets too many emails, I called their banker and asked if they could increase the line of credit.

The banker said, ‘sure, we’ll look at it, send me a financial projection.’

Next, I asked how come the bank didn’t increase their line over the last couple of years?

What the banker said next floored me.

‘I’m too busy, I have over 200 clients, and don’t have time to monitor everyone.’

In other words, the banker was likely paying attention to the problem accounts, and ignoring the healthy, growing accounts.

That day, I moved this client to a different, better, more proactive banker who quickly provided the $400,000 line of credit.

Result: happy owner, growing business.

Financing Success Stories

Mobil Grain: $5 million to purchase a railroad

EMW Industrial: $4.5 million line of credit

Prairie Clean: $2.5 million in private debt, $3.25 million in bank funding

Crown Chiro: Mortgage funding for land purchase and building construction

KSP Technology: Mortgage funding to buy a building

Retail: Line of credit for inventory and operations

Vet clinic: purchase a clinic

What you Get — At A Glance

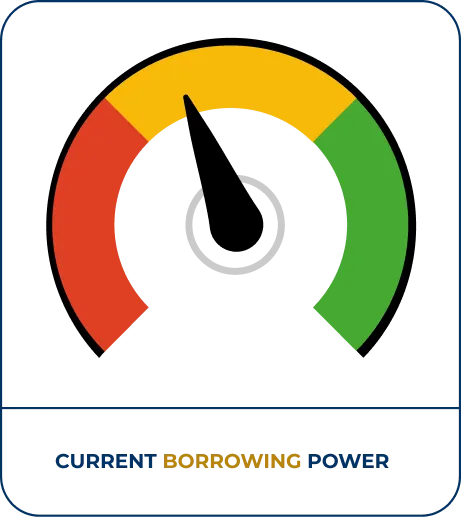

Your current borrowing limit

Your future borrowing potential

BLAST™ Scorecard

Steps to Improve your Borrowing Power

Call with Phil

Investment $1,500

$100K Guarantee

How BLAST™ Works:

It’s quick. It will only take 10 min to upload three documents. We’ll do the rest.

How BLAST™ Works: 3 step process

Step 1:

Sign Up & Pay

Step 2:

Upload Your Financials

Step 3:

Discuss your BLAST™ Report

See how much you could borrow – purchase your BLAST™ report now. Only $1,500. Our guarantee: If we can’t find $100,000 of additional borrowing power in your business, you get your money back.

Our Guarantee: If we can’t find an additional $100,000 of borrowing potential in your business, you get your money back.

1. Borrowing Power, Quantified

See exactly what you could qualify for right now.

We dig into your numbers, benchmark your business, and show you the real amount lenders might offer today.

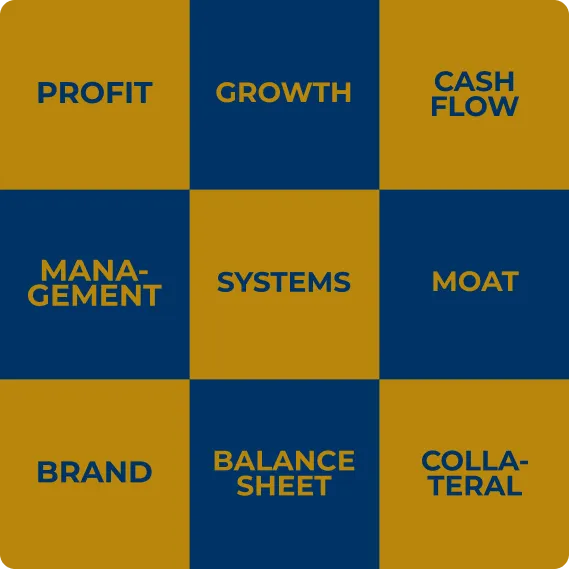

2. Leverage What You’ve Got

Don’t leave your strengths - and dollars - on the table.

We spotlight what’s already working in your business that lenders value most, so you improve your odds right from the start.

Entrepreneurs focus on revenue.

Bankers focus on:

Your balance sheet,

Strength of your management team, and

Business model among other factors to determine how credit worthy you are, how much risk they see, and how much they want to lend you.

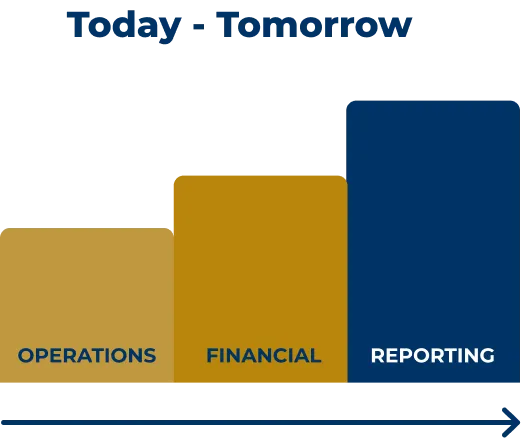

3. Accelerate Your Potential

Get a clear roadmap from “Today” to “Tomorrow.”

We model how targeted adjustments - operational, financial, or reporting - could open the door to bigger loans and better terms down the line.

You get more control and more confidence about your future.

Purchase the BLAST™ Report ($1,500)

Determine your current and future borrowing potential, and the steps to improve it. Includes an optional call with Phil.

4. Structure for Trust

Make lenders confident before you even ask.

We fine-tune your reporting and business structure, so every lender sees a business that deserves trust, respect, and funding.

Proactive and professional communication builds trust, every time.

5. Track & Celebrate Progress

Your growth map, in plain English.

You leave with a custom BLAST™ Report and Scorecard pinpointing where you stand, what to improve, and exactly how to get there.

You can implement the plan, or we can help you implement and even negotiate with bankers on your behalf (additional fees apply).

Who is BLAST™ For?

BLAST™ is built for business owners who want more than a guess on where they stand with their banker. Owners who want real answers, real options, and a real plan before making their next financing request.

Who this is for:

Read More

Your established business is at least five years old, and you are or have been profitable, and want to grow your business.

You want financing to support growth.

You are current with all tax remittances, government filings, loan payments.

You have an external accountant (CPA) prepare your annual financial statements.

You have access to timely and accurate financial information and are willing to be share it.

You are willing to listen to expert advice and do your best to implement the advice.

Who this is not for:

Read More

Start-ups, companies in financial distress or litigation or partner break-ups.

You don’t trust bankers.

You are not up-to-date with your taxes, government filings or loan payments.

You don’t use a CPA or don’t prepare annual financial statements.

You’re don’t have timely or accurate financial information, or you’re not willing to share your financial statements

You’re not willing to listen to advice or try different methods.

What You Get

Your business’s current borrowing capacity, in dollars, and your future borrowing potential ($3,000 value)

A clear, lender-friendly BLAST™ Scorecard ($1,000 value)

Personalized action steps to elevate your borrowing power ($1,000 value)

A “lender’s-eye-view” of your business, simplified ($500 value)

Honest, expert recommendations, never sugar-coated, always useful

Optional call with Phil—Free—to discuss your implementation and next steps ($1,500 value)

$7,000 value. You pay $1,500. Offer may change at any time. Limited slots each month.

Our Guarantee: If we can’t find at least $100,000 of additional borrowing power potential, you get your money back.

Ready to Know How Much

You Can Borrow?

Purchase the BLAST™Report ($1,500).

Find out your business’s true borrowing power - fast, clear, and without the runaround. Includes an optional call with Phil.

Stop guessing, start growing. Get your BLAST™ report now

Book a BLAST™

Discovery Call.

Not ready to buy? Book a call with Phil and see if this process is a good investment for you.

No obligation—just answers”

Phil helps us lend more money into a lower risk situation.

Frequently Asked Questions

How much does the BLAST™ report cost?

Your investment to determine your current and future potential borrowing power is only $1,500. Our guarantee: If we can’t find $100,000 of additional borrowing power in your business, you get your money back.

Will this guarantee that a bank will lend me money?

No one can guarantee what any bank will do in any situation with any client or financing request. Our guarantee: If we can’t find $100,000 of additional borrowing power in your business, you get your money back. However, we can help you learn what the banks are looking for, why it’s important to them, and how you can best meet these criteria

Can I get my money back if I don’t like your report?

No, as the service is prepaid and non-refundable for any reason. We know our report will identify and address important factors that will make your business more fundable, and more valuable to you. Therefore, we deserve to be compensated for that value.

How long will this process take?

7 – 10 business days from when you provide us with your completed information package. This package includes information already at your fingertips, so it should take about 10 minutes to find and upload. If it takes longer, don’t worry, we can help you organize this info better in the future.

What homework do I need to do during the process?

After you upload your financial information, which should take 10 min to collect and submit, you don’t have any homework.

What information do you need?

You complete a simple one-page questionnaire. Then, you upload last year’s accountant prepared financial statements (the full set: balance sheet, income statement, notes) in pdf format. Your internal year to date income statement and balance sheet, for the most recent completed month end, ideally exported from your accounting system into Excel). You are welcome to send additional info if you have it, such as your budget, business plan, aged accounts receivable and accounts payable. We’ll include this info in our analysis at no extra cost to you. We do the work. You get the value. Same price.

How do we submit this information, and is it secure?

Yes, it’s secure. You use our secure upload system at this link: https://filerequestpro.com/up/grumpy-cfo

What will I get from you?

You’ll receive a two-page summary report with a scorecard showing your current borrowing potential, your future borrowing potential, and the critical factors that you need to address and how to address them, to move towards your future borrowing potential. We will have an optional call to discuss the results and recommendations for next steps. We will discuss how we can help you achieve your long-term goals and build business wealth. The call is optional; you are free to not take advantage of it.

Phil Symchych, CPA, MBA, CMC, ICD.D

The Business Wealth Builder®

The Grumpy CFO®

Originally Established 1994®

CONTACT

PHIL SYMCHYCH

(Toll-free North America)

Regina, Saskatchewan,

Canada

© 2026 Grumpy CFO. The Business Wealth Builder® and The Grumpy CFO® are registered trademarks. All Rights Reserved.